In the world of finance, every decision matters. Whether you’re navigating credit, diving into cryptocurrencies, or exploring traditional investing avenues, your choices shape your financial destiny. Here at FinanceVintage, we empower you with timeless strategies and contemporary insights to ensure your investments pay dividends.

The Credit Conundrum: Mastering Your Financial Scorecard

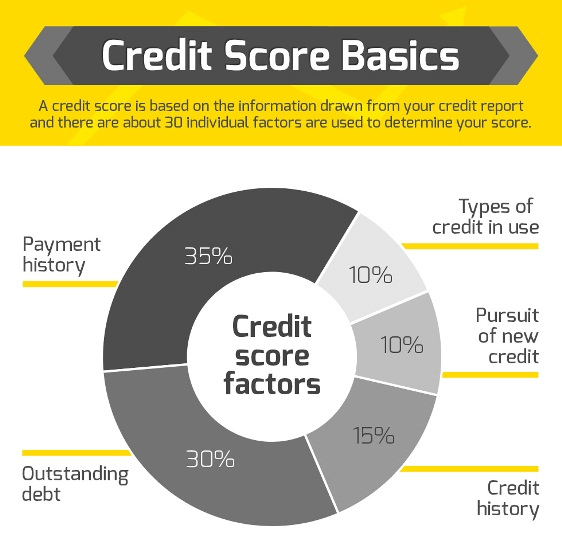

Understanding credit is foundational to financial health. A robust credit score not only unlocks better lending terms but also signifies sound financial management. Begin by checking your credit reports regularly and addressing discrepancies swiftly. Leveraging credit cards responsibly—keeping balances low and payments timely—is key to enhancing your financial profile.

Cryptocurrency: Beyond the Hype

Cryptocurrencies offer thrilling potential but come with inherent risks. Diversifying your crypto holdings mitigates these risks substantially. Beyond Bitcoin and Ethereum, consider exploring altcoins with strong use-cases and active development communities. Engage regularly with market trends, regulatory updates, and technological advancements to inform strategic investment decisions.

Smart Investing: Balancing Risk and Reward

Effective investing requires balancing potential returns with acceptable risks. Embrace asset allocation principles: diversify across equities, bonds, real estate, and commodities to protect your portfolio from volatility. Remember, investing is not a sprint but a marathon. Patiently nurturing your investments allows compounding returns to work their magic.

Emerging Trends: Investing in a Rapidly Evolving Market

Stay ahead of the curve by recognizing and capitalizing on market trends early. Renewable energy, artificial intelligence, and biotechnology are sectors offering tremendous growth potential. Investing in ETFs and mutual funds focused on these sectors can provide exposure without the risk associated with individual stock picks.

Practical Tips for Maximizing Your Returns

- Consistent Investing: Regular, disciplined investing—especially through dollar-cost averaging—can significantly smooth out market fluctuations.

- Continuous Education: Financial literacy is a lifelong pursuit. Regularly read financial reports, subscribe to insightful newsletters, and participate in investor communities.

- Emotional Discipline: Avoid impulsive decisions driven by market hype or panic. Adopting a measured, methodical approach enhances long-term performance.

Financial Security: Building a Resilient Portfolio

A resilient portfolio withstands economic downturns. Include defensive assets such as treasury bonds, dividend-paying stocks, and real estate investment trusts (REITs). Moreover, maintaining a sufficient emergency fund ensures you won’t prematurely liquidate investments during crises.

Conclusion: Invest Wisely, Reap Richly

Financial success stems from informed decisions and disciplined execution. With FinanceVintage as your guide, you’ll gain the clarity, confidence, and actionable insights necessary to navigate credit management, cryptocurrency investments, and traditional finance. Let’s invest wisely together and watch your financial dreams become realities

Leave a comment